Suze Orman's Tells Caller that $200K Savings Won't Cut It for Homeownership

Can You Afford Your Dream Home? Suze Orman Offers Guidance to Single Earner on "Women and Money" Podcast

In a recent episode of the popular financial podcast "Women and Money," a dilemma faced by many Americans in today's housing market took center stage. Nicole, a 47-year-old single woman living in Staten Island, NY, called in to seek Suze Orman's advice on whether it was time for her to ditch renting and pursue homeownership.

Staten Island Prices Strain Budget: Dream of Homeownership vs. Financial Security

Staten Island, with an average home price of 700,000,𝑝𝑟𝑒𝑠𝑒𝑛𝑡𝑒𝑑𝑎𝑠𝑖𝑔𝑛𝑖𝑓𝑖𝑐𝑎𝑛𝑡𝑓𝑖𝑛𝑎𝑛𝑐𝑖𝑎𝑙ℎ𝑢𝑟𝑑𝑙𝑒𝑓𝑜𝑟𝑁𝑖𝑐𝑜𝑙𝑒.𝐷𝑒𝑠𝑝𝑖𝑡𝑒𝑎ℎ𝑒𝑎𝑙𝑡ℎ𝑦𝑖𝑛𝑐𝑜𝑚𝑒𝑜𝑓195,000 annually, her 200,000𝑖𝑛𝑙𝑖𝑞𝑢𝑖𝑑𝑠𝑎𝑣𝑖𝑛𝑔𝑠𝑎𝑛𝑑1 million in retirement savings fell short of the resources needed for a comfortable down payment and a secure financial future after purchase.

Family Ties vs. Financial Freedom: Prioritizing Values in Financial Decisions

The situation became even more complex when Nicole expressed her desire to stay close to her 75-year-old mother and family. Relocating to a lower-cost state, while potentially advantageous financially, meant sacrificing the closeness of loved ones. This highlighted a core tenet of Suze Orman's financial philosophy: prioritizing personal values before making purely financial decisions.

Suze Orman Advises Caution: Job Security and Emergency Fund Considerations

Suze Orman, known for her no-nonsense approach to personal finance, commended Nicole for seemingly already recognizing the challenges. She emphasized the importance of job security, particularly at this stage in Nicole's career, where a 30-year mortgage might not align with her long-term employment plans. Additionally, Orman pointed out the risk of a large mortgage payment potentially draining emergency savings in case of unforeseen circumstances.

Savings Analysis: Down Payment vs. Emergency Fund Security

Even with Nicole's seemingly substantial savings, Orman conducted a reality check. A down payment on a 700,000ℎ𝑜𝑚𝑒𝑐𝑜𝑢𝑙𝑑𝑟𝑎𝑛𝑔𝑒𝑓𝑟𝑜𝑚70,000 to 140,000,𝑙𝑒𝑎𝑣𝑖𝑛𝑔𝑎𝑚𝑒𝑎𝑔𝑒𝑟60,000 in emergency savings – an insufficient safety net. Factoring in her non-retirement investments, the total remaining savings would still fall short, leading Orman to advise against homeownership at this particular time.

Strategic Renting and Long-Term Planning: Building a Future on Solid Ground

Suze Orman ultimately steered Nicole towards strategic renting. By continuing to rent and keep expenses low, Nicole could build a more robust financial cushion. This strategy would allow her to either save enough for a comfortable down payment on a future home or relocate to a lower-cost state for retirement with the financial freedom to purchase outright.

Categories

- All Blogs (183)

- "Stranger Things" House For Sale (1)

- A Grand Slam in Urban Renewal: The Remarkable Transformation of Bush Stadium (1)

- Bill Gates' Xanadu 2.0: A Tour of the Billionaire's $130M Medina Mansion (1)

- Boxing Legend Oscar De La Hoya Lists Henderson Home for $20 Million (1)

- Cadence in Henderson Leads Las Vegas Valley in New Home Construction (1)

- Cryptocurrency and Blockchain (4)

- Escape to Luxury: Discover the Ultimate Mountain Retreat in Las Vegas (1)

- Escape to Your Own Fortress of Solitude: Nova Scotia's $11.5 Million Private Island Haven (1)

- Experience Exquisite Living at 1860 Hatfields Court, Henderson, NV 89044 (1)

- Experts Stunned by Las Vegas Luxury Summer Home Sales (1)

- Hollywood Comes to Vegas (1)

- Is 2024 the Year to Strike Gold in Las Vegas Real Estate? (1)

- Las Vegas Businesses Convert Vacant Offices to Save Costs (1)

- Las Vegas Has Eight Years of Land Left (1)

- Las Vegas Home Builders Experience Best First Quarter Since 2021 (1)

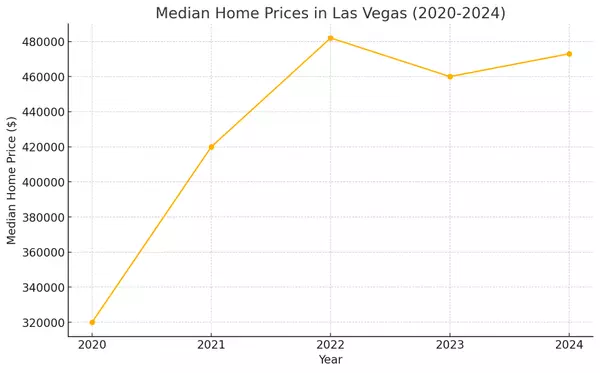

- Las Vegas Home Prices Soar: Median Price Hits $473,000, Closing in on All-Time Record (1)

- Las Vegas Homebuilding Boom: Top Companies Leading the Charge (1)

- Las Vegas Homeowner Takes on City Hall Over $180,000 Airbnb Fine, Alleging Violation of Due Process and Excessive Punishment (1)

- Las Vegas Housing Crisis: A Desert Mirage of Affordability (1)

- Las Vegas Housing Market Market Surge Continues (1)

- Las Vegas Luxury Real Estate: $35 Million Sale Sets New Record in The Summit Club (1)

- Las Vegas Population Explosion: How UNLV's 1996 Forecast Predicted Today's 2.4 Million Clark County Residents (1)

- Las Vegas Real Estate Market Insights: Top Trends, Home Buying Tips, and Best Neighborhoods (1)

- Las Vegas Real Estate Market Report: Homes Sell Fast in May 2024 (1)

- Las Vegas Real Estate Market Update (1)

- Las Vegas Real Estate Trends: Current Market Snapshot (1)

- Las Vegas Strikes Gold with Affluent Tourists and Residents: A Booming Tourism and Migration Report (1)

- Las Vegas Valley Sees Surge in Investor Home Purchases (1)

- Luxury Living in Las Vegas: SkyVu Unveils New Model Homes in MacDonald Highlands (1)

- Luxury Living in Las Vegas: The Ultimate High-Rise Experience (1)

- Market Update (1)

- Mesquite, Nevada: The Hidden Oasis Attracting Retirees and Reshaping the Silver State's Landscape (1)

- Newsletter (1)

- Pee-wee Herman's Iconic Los Feliz Home for Sale: $5 Million (1)

- Southwest Las Vegas Growth (1)

- Step into the Legendary Home of Jerry Lewis: A Piece of Hollywood History Hits the Market (1)

- Suze Orman's Tells Caller that $200K Savings Won't Cut It for Homeownership (1)

- The Canyon at Ascaya (1)

- The Dink Revolution: Pickleball Takes Over Las Vegas (1)

- The real ‘Full House’ house in San Francisco and where to find it (1)

- The Summit Club (1)

- The Treetop Revolution: How Luxury Treehouse Mansions Are Redefining the Skyline (1)

- Tropicana Las Vegas Demolition Preparing for Implosion to Make Way for MLB Stadium (1)

- Unearthed: The Hidden World of Luxury Cave Homes (1)

- Why the Surge in Construction Won't Lead to a Housing Market Crash (1)

Recent Posts

GET MORE INFORMATION