Las Vegas Has Eight Years of Land Left

The Las Vegas Valley faces a dire housing crisis. It has an eight-year window before it runs out of land for new homes. Tina Frias is the CEO of the Southern Nevada Home Builders Association. She sounds the alarm on the need for it to keep a healthy balance between housing supply and demand.

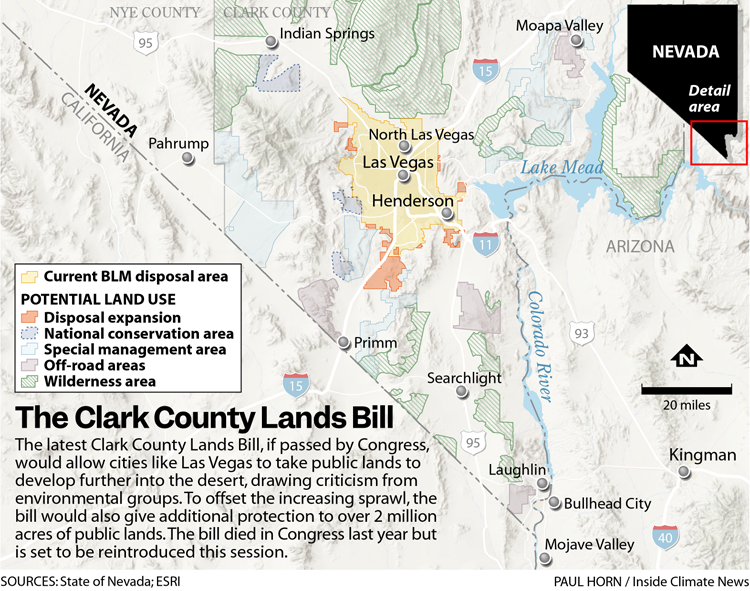

The association supports a federal lands bill. The bill would make more desert land open for development, Frias said. Gov. Joe Lombardo endorsed the bill. It's aimed to cut red tape and improve land access for development.

Clark County confirmed that the federal government owns 88% of all the county's land. The Bureau of Land Management manages over half of it. The BLM’s Southern Nevada district manages 2.6 million acres alone in Clark County.

A spokesperson for the BLM’s Southern Nevada district said that the act passed in 1998. It told the BLM to sell public lands. The lands were within specific boundaries in the Las Vegas Valley. The spokesperson said that stakeholders have sold, leased, or patented almost 44,000 acres. Another 27,000 acres of land is still available for disposal.

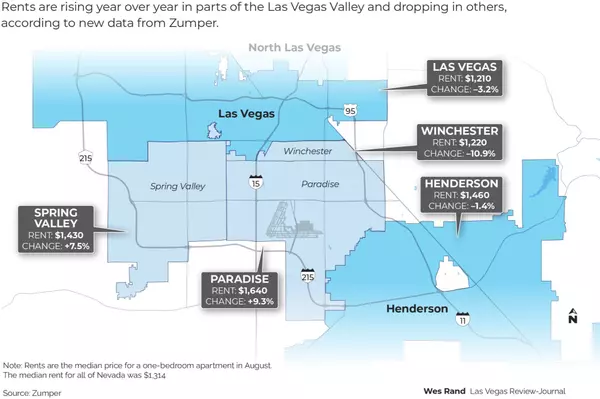

Many real estate experts and analysts told the Review-Journal that this. They said a lack of land and government red tape are major reasons. They say these problems have caused it's a “housing crisis” that is raising real estate prices.

Nicholas Irwin is an economics assistant professor at UNLV. He is also a researcher at the Lied Center for Real Estate. He said that the valley’s population will keep growing. So, the need for more land to develop is very important.

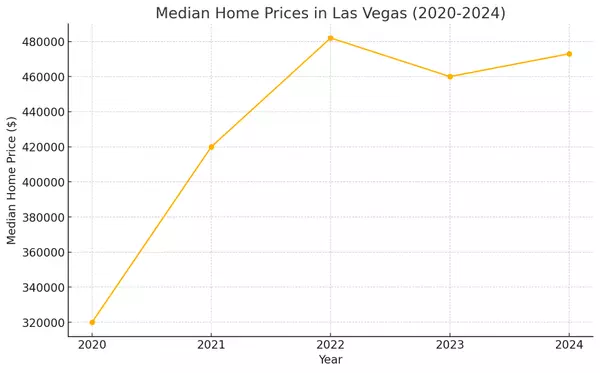

Redfin estimates the median home price in the valley is up 9.2 percent from this time last year to $435,000. Home prices jump $100,000 in three years, while sales collapse.

Brian Gordon is a principal at Applied Analysis. He said that making enough housing is a lasting issue.

Frias said the valley housing stock comes down to the three L’s: lumber, labor, and land. She cited a shortage of land as a major issue. She said many people got into homes during the pandemic, when interest rates were very low. Now, they're content to sit on the properties they bought, which takes them out of the resale stock.

“Right now, we're in a pretty unique circumstance. Buyers are sitting on homes with interest rates of 4 percent or less. They're not likely to give up that rate, so that impacts inventory. So, there's a lack of inventory. And, mortgage rates are higher than they were a few years ago. This makes it hard to match housing options with demand.”

Categories

- All Blogs (183)

- "Stranger Things" House For Sale (1)

- A Grand Slam in Urban Renewal: The Remarkable Transformation of Bush Stadium (1)

- Bill Gates' Xanadu 2.0: A Tour of the Billionaire's $130M Medina Mansion (1)

- Boxing Legend Oscar De La Hoya Lists Henderson Home for $20 Million (1)

- Cadence in Henderson Leads Las Vegas Valley in New Home Construction (1)

- Cryptocurrency and Blockchain (4)

- Escape to Luxury: Discover the Ultimate Mountain Retreat in Las Vegas (1)

- Escape to Your Own Fortress of Solitude: Nova Scotia's $11.5 Million Private Island Haven (1)

- Experience Exquisite Living at 1860 Hatfields Court, Henderson, NV 89044 (1)

- Experts Stunned by Las Vegas Luxury Summer Home Sales (1)

- Hollywood Comes to Vegas (1)

- Is 2024 the Year to Strike Gold in Las Vegas Real Estate? (1)

- Las Vegas Businesses Convert Vacant Offices to Save Costs (1)

- Las Vegas Has Eight Years of Land Left (1)

- Las Vegas Home Builders Experience Best First Quarter Since 2021 (1)

- Las Vegas Home Prices Soar: Median Price Hits $473,000, Closing in on All-Time Record (1)

- Las Vegas Homebuilding Boom: Top Companies Leading the Charge (1)

- Las Vegas Homeowner Takes on City Hall Over $180,000 Airbnb Fine, Alleging Violation of Due Process and Excessive Punishment (1)

- Las Vegas Housing Crisis: A Desert Mirage of Affordability (1)

- Las Vegas Housing Market Market Surge Continues (1)

- Las Vegas Luxury Real Estate: $35 Million Sale Sets New Record in The Summit Club (1)

- Las Vegas Population Explosion: How UNLV's 1996 Forecast Predicted Today's 2.4 Million Clark County Residents (1)

- Las Vegas Real Estate Market Insights: Top Trends, Home Buying Tips, and Best Neighborhoods (1)

- Las Vegas Real Estate Market Report: Homes Sell Fast in May 2024 (1)

- Las Vegas Real Estate Market Update (1)

- Las Vegas Real Estate Trends: Current Market Snapshot (1)

- Las Vegas Strikes Gold with Affluent Tourists and Residents: A Booming Tourism and Migration Report (1)

- Las Vegas Valley Sees Surge in Investor Home Purchases (1)

- Luxury Living in Las Vegas: SkyVu Unveils New Model Homes in MacDonald Highlands (1)

- Luxury Living in Las Vegas: The Ultimate High-Rise Experience (1)

- Market Update (1)

- Mesquite, Nevada: The Hidden Oasis Attracting Retirees and Reshaping the Silver State's Landscape (1)

- Newsletter (1)

- Pee-wee Herman's Iconic Los Feliz Home for Sale: $5 Million (1)

- Southwest Las Vegas Growth (1)

- Step into the Legendary Home of Jerry Lewis: A Piece of Hollywood History Hits the Market (1)

- Suze Orman's Tells Caller that $200K Savings Won't Cut It for Homeownership (1)

- The Canyon at Ascaya (1)

- The Dink Revolution: Pickleball Takes Over Las Vegas (1)

- The real ‘Full House’ house in San Francisco and where to find it (1)

- The Summit Club (1)

- The Treetop Revolution: How Luxury Treehouse Mansions Are Redefining the Skyline (1)

- Tropicana Las Vegas Demolition Preparing for Implosion to Make Way for MLB Stadium (1)

- Unearthed: The Hidden World of Luxury Cave Homes (1)

- Why the Surge in Construction Won't Lead to a Housing Market Crash (1)

Recent Posts

GET MORE INFORMATION