Is 2024 the Year to Strike Gold in Las Vegas Real Estate?

Categories

- All Blogs (183)

- "Stranger Things" House For Sale (1)

- A Grand Slam in Urban Renewal: The Remarkable Transformation of Bush Stadium (1)

- Bill Gates' Xanadu 2.0: A Tour of the Billionaire's $130M Medina Mansion (1)

- Boxing Legend Oscar De La Hoya Lists Henderson Home for $20 Million (1)

- Cadence in Henderson Leads Las Vegas Valley in New Home Construction (1)

- Cryptocurrency and Blockchain (4)

- Escape to Luxury: Discover the Ultimate Mountain Retreat in Las Vegas (1)

- Escape to Your Own Fortress of Solitude: Nova Scotia's $11.5 Million Private Island Haven (1)

- Experience Exquisite Living at 1860 Hatfields Court, Henderson, NV 89044 (1)

- Experts Stunned by Las Vegas Luxury Summer Home Sales (1)

- Hollywood Comes to Vegas (1)

- Is 2024 the Year to Strike Gold in Las Vegas Real Estate? (1)

- Las Vegas Businesses Convert Vacant Offices to Save Costs (1)

- Las Vegas Has Eight Years of Land Left (1)

- Las Vegas Home Builders Experience Best First Quarter Since 2021 (1)

- Las Vegas Home Prices Soar: Median Price Hits $473,000, Closing in on All-Time Record (1)

- Las Vegas Homebuilding Boom: Top Companies Leading the Charge (1)

- Las Vegas Homeowner Takes on City Hall Over $180,000 Airbnb Fine, Alleging Violation of Due Process and Excessive Punishment (1)

- Las Vegas Housing Crisis: A Desert Mirage of Affordability (1)

- Las Vegas Housing Market Market Surge Continues (1)

- Las Vegas Luxury Real Estate: $35 Million Sale Sets New Record in The Summit Club (1)

- Las Vegas Population Explosion: How UNLV's 1996 Forecast Predicted Today's 2.4 Million Clark County Residents (1)

- Las Vegas Real Estate Market Insights: Top Trends, Home Buying Tips, and Best Neighborhoods (1)

- Las Vegas Real Estate Market Report: Homes Sell Fast in May 2024 (1)

- Las Vegas Real Estate Market Update (1)

- Las Vegas Real Estate Trends: Current Market Snapshot (1)

- Las Vegas Strikes Gold with Affluent Tourists and Residents: A Booming Tourism and Migration Report (1)

- Las Vegas Valley Sees Surge in Investor Home Purchases (1)

- Luxury Living in Las Vegas: SkyVu Unveils New Model Homes in MacDonald Highlands (1)

- Luxury Living in Las Vegas: The Ultimate High-Rise Experience (1)

- Market Update (1)

- Mesquite, Nevada: The Hidden Oasis Attracting Retirees and Reshaping the Silver State's Landscape (1)

- Newsletter (1)

- Pee-wee Herman's Iconic Los Feliz Home for Sale: $5 Million (1)

- Southwest Las Vegas Growth (1)

- Step into the Legendary Home of Jerry Lewis: A Piece of Hollywood History Hits the Market (1)

- Suze Orman's Tells Caller that $200K Savings Won't Cut It for Homeownership (1)

- The Canyon at Ascaya (1)

- The Dink Revolution: Pickleball Takes Over Las Vegas (1)

- The real ‘Full House’ house in San Francisco and where to find it (1)

- The Summit Club (1)

- The Treetop Revolution: How Luxury Treehouse Mansions Are Redefining the Skyline (1)

- Tropicana Las Vegas Demolition Preparing for Implosion to Make Way for MLB Stadium (1)

- Unearthed: The Hidden World of Luxury Cave Homes (1)

- Why the Surge in Construction Won't Lead to a Housing Market Crash (1)

Recent Posts

FEDERAL STRANGLEHOLD: How Uncle Sam's Iron Grip is Choking Las Vegas' Land Dreams

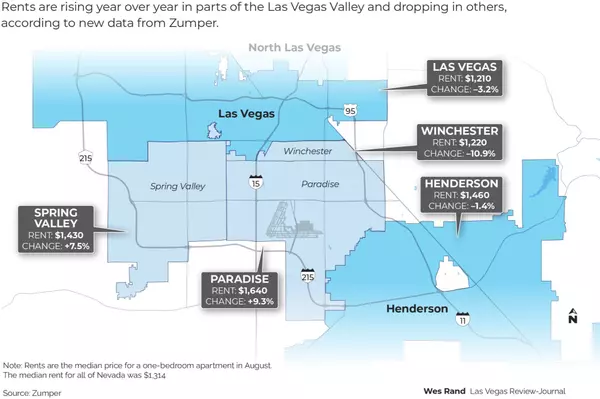

Dramatic Shifts in Las Vegas Rent: Where Prices Are Rising and Falling

Sellers Shake Up Real Estate: Buyer Agent Fees Under Fire in Hot Markets!

Las Vegas Realtors CEO Suspended Over Election Scandal

Las Vegas Hit with $30M Court Ruling Over Badlands Golf Course Puts City’s Finances at Risk

The History of Real Estate

Exploring the Booming Las Vegas Real Estate Market: Trends and Opportunities

The Great Commission Drop of 2024 Shakes Up the Housing Market!

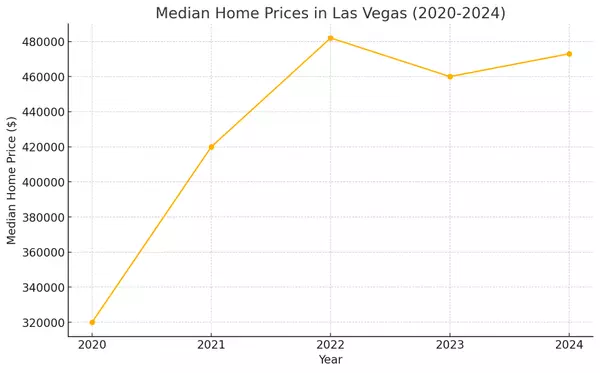

Las Vegas Home Prices: The Shocking Post-2020 Surge

Unique Historical Homes: The Stories Behind Them

GET MORE INFORMATION